State program "Affordable loans 5-7-9%"

The program is implemented with the support of the President and the Government of Ukraine

Get a consultation

The Affordable Loans 5-7-9% program is for you if

- you are a legal entity or an individual entrepreneur, which is a resident of Ukraine;

- the ultimate beneficial owner (controller) is a resident of Ukraine;

- conducting business for more than 12 months.;

- you are not a person, the participant (shareholder, member) or ultimate beneficiary of which is a citizen of the state recognized by Ukraine as the aggressor state or the occupying state, and / or a person who belongs or belonged to terrorist organizations, the legal entity which participants (shareholders, members) or ultimate beneficiaries are persons who belong or belonged to terrorist organizations

- the business entity, together with the members of the Group of related counterparties, has not received state support in the last three calendar years exceeding the amount equivalent to EUR 200,000.00 determined at the official exchange rate set by the NBU as of the last day of the financial year, in accordance with the Law of Ukraine "On Government Aid to Business Entities". Restrictions on the amount of government support do not apply to micro, small, medium and large business entities carrying out activities in the energy sector, agricultural production and fishing, as well as to all micro, small, medium and large business entities during the period of martial law.

Benefits of the "Affordable loans 5-7-9%" program

For what purposes the loan is provided?

- For the development of entrepreneurship, individual entrepreneurs.

- Replenishment of working capital.

- Lending to agricultural producers.

- Lending to prevent Russian aggression and overcome its consequences.

- Restoration, repair and replacement of energy infrastructure, thermal power plants, combined heat and power plants.

Priority lending areas

- restoration of fixed assets of micro, small, medium and large enterprises destroyed as a result of military aggression;

- support for micro, small, medium and large enterprises by prolonging existing loans granted to finance working capital in accordance with the Procedure for up to twelve (12) months, which conduct business activities and/or whose production facilities are located (were located) in the territories included in the list of territories where military operations were conducted and/or in the territories temporarily occupied by the Russian Federation, approved by the relevant resolution of the Cabinet of Ministers;

- financing of agricultural producers for conducting agricultural activities;

- support for business entities engaged in the production, processing of agricultural products and their sale under economic activities 10.51, 10.61, 10.71 in accordance with the Classification of Economic Activities.

- restoration, repair or replacement of the energy infrastructure of thermal power plants and combined heat and power plants damaged as a result of hostilities, which is confirmed by the relevant certificate, necessary for the stable autumn-winter period of 2023/24, provided that the operability of generating facilities is ensured until the end of the autumn-winter period 2023/24, in accordance with the schedules for the repair of the main equipment of power plants and combined heat and power plants approved by the Ministry of Energy of Ukraine.

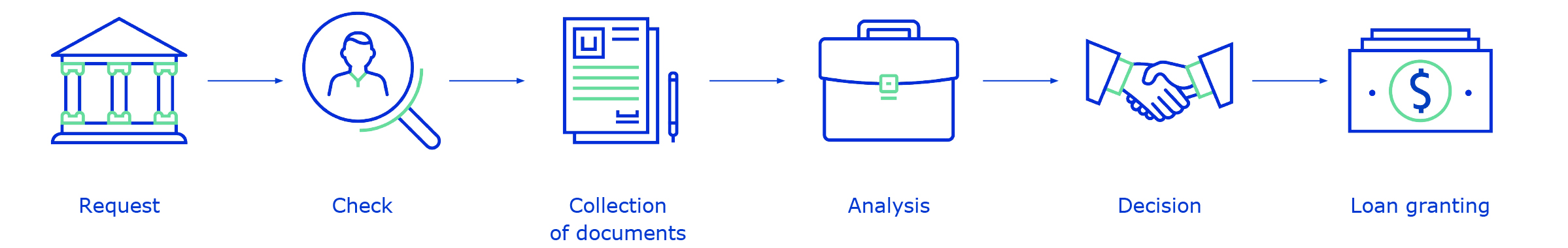

Process of granting loan

- Request. Minimum package of documents.

- Business reputation check. Short analysis. Offer or Refusal.

- Collection of necessary documents.

- Financial and economic analysis. Legal analysis. Valuation of collateral.

- Loan decision.

- Loan granting.

Basic lending conditions

- Amount - up to UAH 90 million for all loans within the Program for a group of related parties.

- Currency — UAH.

- Loan term - up to 5 years for investment loans; up to 3 years - for working capital loans; up to 12 months - for trading companies; until March 31, 2024 - for loans to agricultural producers, up to 120 months - for loan(s) granted to micro, small, medium and large enterprises for investment purposes related to the restoration, repair or replacement of the energy infrastructure of thermal power plants and combined heat and power plants damaged as a result of hostilities, as confirmed by a relevant certificate, needed for the sustainable course of the autumn-winter period 2023/24, provided that the operability of the generating facilities is ensured until the end of the autumn-winter period 2023/24 in accordance with the schedules for the repair of the main equipment of power plants and combined heat and power plants approved by the Ministry of Energy of Ukraine.

- Own contribution - from 10%.

- Collateral - the lending object, if it belongs to the main types of collateral; other liquid movable and immovable property; financial guarantee.

- Loan fee - up to 0.75% of the loan limit.

- Loan service fee (operating expenses) - up to 0.75% of the loan limit.

| CONDITIONS | BID | DESCRIPTION |

|

Investment objectives (except for the restoration of fixed assets destroyed as a result of military aggression) |

7%* |

• for micro and small enterprises |

|

9% |

• for medium and large enterprises |

|

|

Investment objectives (for restoration of fixed assets destroyed as a result of military aggression) |

5% |

• for micro and small enterprises |

|

7% |

• for medium and large enterprises |

|

|

Financing of working capital (in addition to the restoration of fixed assets destroyed as a result of military aggression and support by prolonging existing loans, Provision of working capital financing to companies that carry out economic activities and/or whose production facilities are located (were located) in the territories included in the list of territories where military operations are being conducted (were conducted) or temporarily occupied by the Russian Federation, approved by the Ministry of Integration, except for those for which the date of completion of hostilities or temporary occupation is not determined) |

9% |

• for all business segments |

|

Financing of working capital (for the restoration of fixed assets destroyed as a result of military aggression and support through the prolongation of existing loans to finance working capital for companies that conduct business activities and/or whose production facilities are located (were located) in the territories included in the list of territories where military operations are being conducted (were conducted) or temporarily occupied by the Russian Federation, approved by the Ministry of Integration, except for those for which the date of completion of hostilities or temporary occupation is not determined)

|

7% |

• for all business segments |

|

Development and support of individual entrepreneurs |

15% |

• Individual entrepreneurs receive a loan (s) in the amount of up to UAH 3 million to finance their business activities, the loan can be secured by a guarantee |

* The interest rate can be reduced to 5% if new jobs are created.

FAQ

What factors does the bank take into account when making decisions?

- The financial condition of the borrower and the actual turnover of the business.

- The quality of the project, which is the lending object, and the prospects for business development.

- The role of the borrower in the market and the state of the industry.

- Credit history of the borrower and their business reputation.

- Willingness of company owners to provide a guarantee.

Is it possible to repay the loan early?

Yes, without penalties.