Quick loan for SMEs

Need a loan?

Quick loan for you if:

-

You are a legal entity or an individual entrepreneur.

-

You have been in business for 12 months or more (trade), 18 months and more (production, services).

-

You have a good credit history and business reputation: there were no bankruptcies, liquidations, overdue budget commitments, etc.

Why do you need a quick loan

- You need money for current activities (except for replenishment of authorized capital and provision / return of financial assistance).

- You need to buy equipment, real estate, car for business development.

Advantages of fast loan

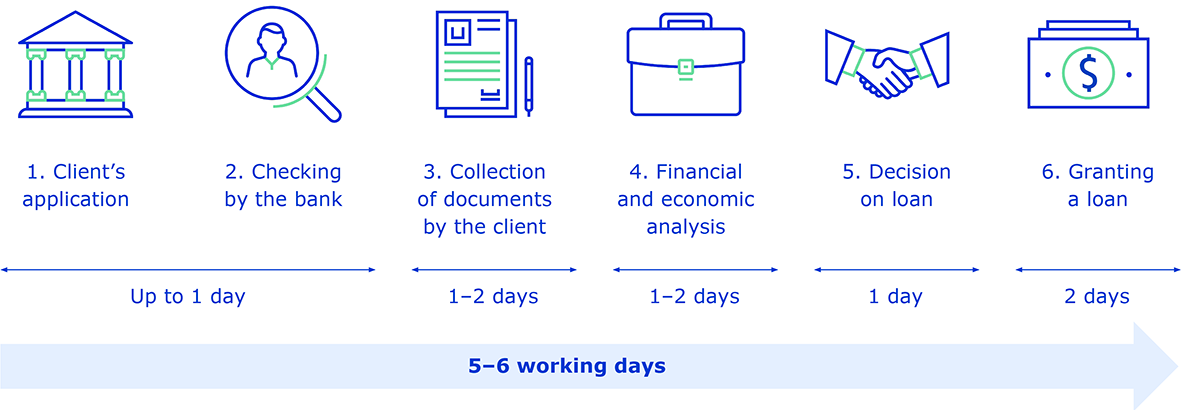

Process of granting loan

How the bank makes decisions

- You contact the bank (fill in the form).

- We study your business and its financial performance.

- You collect the necessary documents (what documents are required).

- The Bank conducts financial and economic analysis and notifies the decision.

- You get a loan.

Frequently Asked Questions

In what currency can I get a loan?

Hryvnia.

What factors does the bank take into account when making decisions?

- Financial condition of the borrower and the actual turnover of the business.

- Quality of the project, which is the object of the loan, and the prospects for business development.

- Role of the borrower in the market and the state of the industry.

- Borrower's credit history and business reputation

- Willingness of company owners to provide a guarantee.

For how long can I take a loan?

Up to 36 months.

For what needs can I use credit funds?

Replenishment of working capital and payment under the agreement / contract of sale for the purchase of fixed assets.

How to repay interest?

Interest is repaid by the 10th day of the month following the reporting month.

Can I repay the loan early?

Yes, without penalties.