Acquiring

Need an acquiring?

Why you should choose the acquiring from ConcordBank

- Increase your customer base and turnover: it is convenient for your customers to pay by cards.

- Reducing the costs of collection and storage of cash, minimizing the risk of accepting counterfeit banknotes or staff errors.

- New equipment and modern payment technologies (cards, gadgets).

- High speed, security and confidentiality of payments due to its processing.

- Refunds the next day, as well as weekends and holidays.

- Individual approach to tariff setting.

- Fast connection, service and provision of materials 24/7.

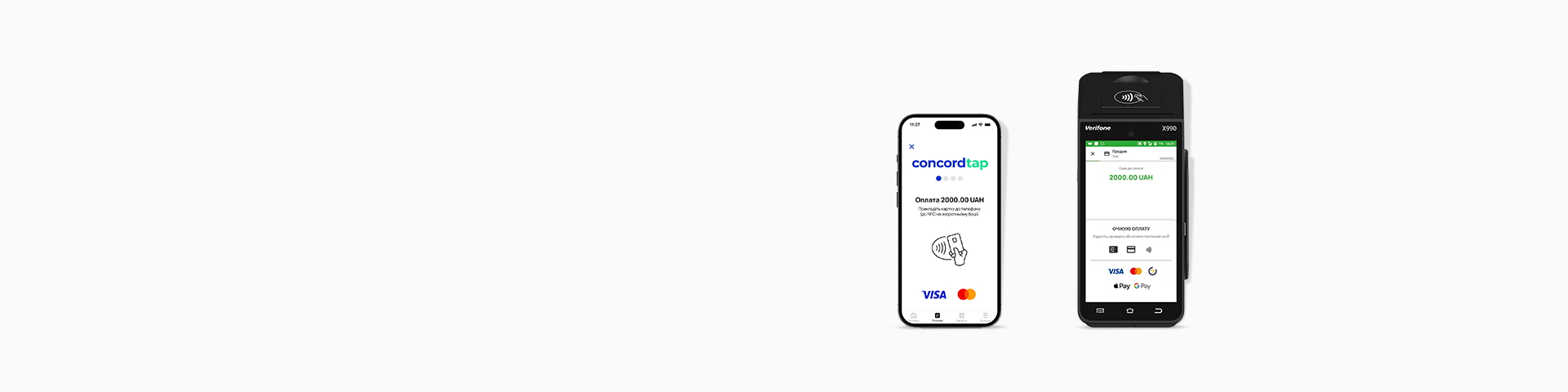

- TapToPhone technology - no POS terminal rental fee, mobility, easy connection. Your ordinary Android smartphone with an NFC module turns into a POS terminal.

Tariffs

|

POS-terminal |

ConcordTap (TapXphone) |

|

| CONNECTING A POS-terminal / ConcordTap (TapXphone) | Free* | Free* |

| Fee for transactions through POS-terminal / ConcordTap (TapXphone) |

1,3% of the transaction amount |

1,3% of the transaction amount |

| Monthly fee for the terminal | UAH 400 | - |

* included in the price of other services within the tariffs.

Questions and answers

How to activate the trade acquiring service and how long will it take?

You can activate the service at ConcordBank branches or via the ConcordBusiness app. On average, installation and connection of the terminal takes from 2 to 5 working days, depending on the location of your business.

Advantages of ConcordTap (TapXphone) compared to a POS terminal:

- accepting payments using a smartphone;

- no fee for renting a POS terminal;

- mobility;

- easy connection;

- ability to accept payments in the absence of electricity;

- ability to use software cash registers (integration with software cash registers from Checkbox, E-check is available).

Does ConcordBank have a choice of POS terminals?

Yes, we have terminals to suit your needs: stationary and mobile terminals, remote keypads. There are also modern touch-screen terminals on the Android operating system with a large touch screen and attractive appearance.

Is it difficult to learn how to use a POS terminal?

We will bring, install and configure the terminal, explain everything and clearly show it, and also leave the instructions. In addition, you can always contact ConcordBank support.

Do I have to open an account with ConcordBank?

The best solution is to open an account with ConcordBank for guaranteed quick refunds, as well as additional income in the form of interest on the balance. But we also make refunds to accounts with other banks.

What to do in case of problems with the terminal?

Contact ConcordBank support 24/7. We will fix the problem remotely or, if necessary, replace the terminal as soon as possible free of charge.

Can several points be connected to one terminal?

Yes, of course, if necessary, several merchants can be connected to one terminal - multimerchant.

Why should I spend money on acquiring if I have a small business?

In the modern world, not being able to accept payment by card or gadget is to be one step behind competitors. Acquiring will increase your average check and turnover, and also reduce the likelihood of fraud.

Document list

The list of documents for opening an account FLP

List of documents for opening an account of a legal entity (resident)